...

Field | Description |

Name | Underlying company name or commodity |

Open | Opening price for the day |

High | The highest trade price for the day |

Low | The lowest trade price for the day |

Close | The last traded price |

Sale Condition | A special condition associated with the trade |

Symbol | The ticker symbol |

Volume | The total number of shares or futures contracts traded for the day |

OI | The total number of futures contracts or options traded that have not yet been liquidated either by an offsetting futures transaction or by delivery |

Volatility | Implied Volatility is the estimated volatility of the underlying stock over the term of the option (only available for equity options) |

Theoretical Value | The hypothetical value of the options, calculated by the Black-Scholes Option Pricing Model (only available for equity options) |

Delta | Measures the sensitivity of an option’s theoretical value to a change in the underlying price (only available for equity options) |

Gamma | Measures the rate of change in the delta for every one point move in the underlying (only available for equity options) |

Theta | The measure of the time decay of an option, the dollar amount that an option will lose each day due to the passage of time (only available for equity options) |

Vega | Measures the sensitivity of the price of an option to changes in volatility (only available for equity options) |

Rho | The rate at which the price of an option changes relative to a change in the risk-free rate of interest (only available for equity options) |

Bid | The highest price a buyer of a security or instrument is willing to pay |

Ask | The lowest price a seller of a security or instrument is willing to offer |

Implied Volatility | The ATM average of the implied volatility of the nearest monthly contract |

IV Change | The underlying asset's change in implied volatility for the current trading session (only available for equity options) |

IV Rank | The current IV compared to the highest and lowest values over the past 1-year. If IV Rank is 100% this means the IV is at its highest level over the past 1-year, and can signify the market is overbought (only available for equity options) |

IV Percentile | The percentage of days with IV closing below the current IV value over the prior 1-year. A high IV Percentile means the current IV is at a higher level than for most of the past year. This would occur after a period of significant price movement, and a high IV Percentile can often predict a coming market reversal in price (only available for equity options) |

Put/Call Volume Ratio | The total Put/Call volume ratio for all option contracts (across all expiration dates). A high put/call ratio can signify the market is oversold as more traders are buying puts rather than calls, and a low put/call ratio can signify the market is overbought as more traders are buying calls rather than puts (only available for equity options) |

Options Volume | The total volume for all option contracts (across all expiration dates) traded during the current session (only available for equity options) |

Put/Call Open Interest Ratio | The put/call open interest ratio for all options contracts across all expiration dates (only available for equity options) |

Total OI | The total open interest for all option contracts across all expiration dates (only available for equity options) |

...

(Note: Historical Tick data is limited to the last 30 days)

Equity Sale Conditions

For ‘Tick’ and ‘Top of Book (BBO)’, below are the sale condition codes for NYSE/NYSE Arca and NASDAQ.

@ – Regular Sale

B – Average Price Trade

C – Cash Trade (Same Day Clearing)

E – Automatic Execution

F – Inter-market Sweep Order

H – Price Variation Trade

I – Odd Lot Trade

K – Rule 127 (NYSE Only) or Rule 155 (NYSE American only)

L – Sold Last (Late Reporting)

M – Market Center Official Close

N – Next Day Trade (Next Day Clearing)

O – Market Center Opening Trade

P – Prior Reference Price

Q – Market Center Official Open

R – Seller

T – Extended Hours Trade

U – Extended Hours Sold (Out Of Sequence)

V – Contingent Trade

X – Cross Trade

Z – Sold (Out Of Sequence)

4 – Derivatively Priced

5 – Market Center Reopening Trade

6 – Market Center Closing Trade

7 – Qualified Contingent Trade

8 – Reserved

9 – Corrected Consolidated Close Price as per Listing Market

Sale Condition Nasdaq - Denotes the sale condition associated with a trade (utp binnary 1.5 page 43)

@ – Regular Sale

A – Acquisition

B – Bunched Trade

C – Cash Sale

D – Distribution

E – Placeholder

F – Intermarket Sweep

G – Bunched Sold Trade

H – Price Variation Trade

I – Odd Lot Trade

K – Rule 155 Trade (AMEX)

L – Sold Last

M – Market Center Official Close

N – Next Day

O – Opening Prints

P – Prior Reference Price

Q – Market Center Official Open3

R – Seller

S – Split Trade

T – Form T

U – Extended trading hours (Sold Out of Sequence)

V – Contingent Trade

W – Average Price Trade

X – Cross Trade

Y – Yellow Flag Regular Trade

Z – Sold (out of sequence)

1 – Stopped Stock (Regular Trade)

4 – Derivatively priced

5 – Re-Opening Prints

6 – Closing Prints

7 – Qualified Contingent Trade

8 – Placeholder For 611 Exempt

9 – Corrected Consolidated Close (per listing market)

Futures Contract Roll

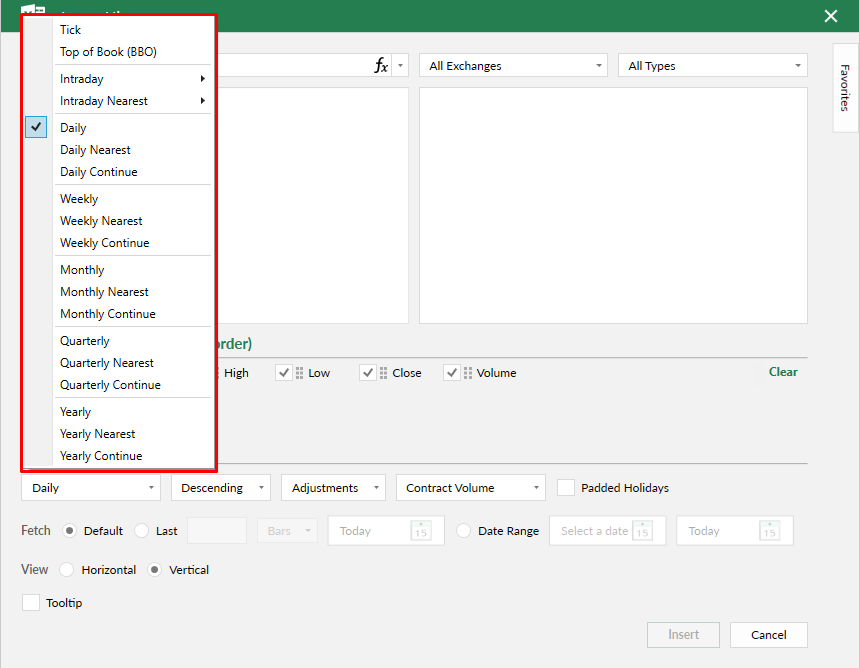

If one of the symbols selected is a futures contract and and either the ‘Nearest’ or ‘Continue’ aggregations have been selected, a new menu will display allowing you to select the futures roll method.

...