cmdtyView offers 90+ studies as of the writing of this of this document and we continue to add new studies regularly. The current list of studies along with their study definitions can be found below.

Accumulation/Distribution Williams

Accumulation is a term used to describe a market controlled by buyers; whereas distribution is defined by a market controlled by sellers.

Williams recommends trading this indicator based on divergences:

Distribution of the security is indicated when the security is making a new high and the A/D indicator is failing to make a new high. Sell.

Accumulation of the security is indicated when the security is making a new low and the A/D indicator is failing to make a new low. Buy.

Calculation:

To calculate Williams' Accumulation/Distribution indicator, first determine the True Range High ("TRH") and True Range Low ("TRL").

TRH = Yesterday's close or today's high, whichever is greater

TRL = Yesterday's close or today's low, whichever is less.

Today's accumulation/distribution is then determined by comparing today's closing price to yesterday's closing price.

If today's close is greater than yesterday's close:

Today's A/D = today's close - TRL

If today's close is less than yesterday's close:

Today's A/D = today's close - TRH

If today's close is equal to yesterday's close:

Today's A/D = 0

The Williams' Accumulation/Distribution indicator is a cummulative total of these daily values.

Williams' A/D = Today's A/D + Yesterday's Williams' A/D

Barchart then applies a 14-day moving average of the results for smoothing.

Default Parameters: Period: 14

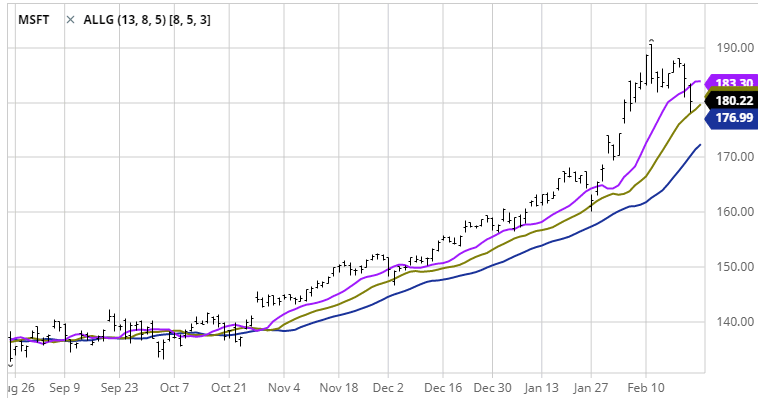

Alligator

"Most of the time the market remains stationary. Only for some 15-30% of time the market generates trends, and traders who are not located in the exchange itself derive most of their profits from the trends. My Grandfather used to repeat: "Even a blind chicken will find its corns, if it is always fed at the same time". We call the trade on the trend "a blind chicken market". It took us years, but we have produced an indicator, that lets us always keep our powder dry until we reach the blind chicken market". -- Bill Williams

The Alligator study was developed by Bill Williams. In principle, Alligator Technical Indicator is a combination of Balance Lines (Moving Averages) that use fractal geometry and nonlinear dynamics.

The blue line (Alligator's Jaw) is the Balance Line for the time frame that was used to build the chart (13-period Smoothed Moving Average, moved into the future by 8 bars);

The green line (Alligator's Teeth) is the Balance Line for the value time frame of one level lower (8-period Smoothed Moving Average, moved by 5 bars into the future);

The purple line (Alligator's Lips) is the Balance Line for the value time frame, one more level lower (5-period Smoothed Moving Average, moved by 3 bars into the future).

Lips, Teeth and Jaw of the Alligator show the interaction of different time periods. As clear trends can be seen only 15 to 30 per cent of the time, it is essential to follow them and refrain from working on markets that fluctuate only within certain price periods.

When the Jaw, the Teeth and the Lips are closed or intertwined, it means the Alligator is going to sleep or is asleep already. As it sleeps, it gets hungrier and hungrier - the longer it will sleep, the hungrier it will wake up. The first thing it does after it wakes up is to open its mouth and yawn. Then the smell of food comes to its nostrils: flesh of a bull or flesh of a bear, and the Alligator starts to hunt it. Having eaten enough to feel quite full, the Alligator starts to lose the interest to the food/price (Balance Lines join together) - this is the time to fix the profit.

Default Parameters:

(13) - Number of Periods to use for Jaw

(8) - Number of Periods to use for Teeth

(5) - Number of Periods to use for Lips

(8,5,3) - Shift for Jaw, Teeth, Lips